Real Estate Investment Trusts (REITs) offer a unique and accessible way to invest in the real estate market without the burdens of direct property ownership. Understanding REITs is crucial for investors seeking portfolio diversification and potential income generation. This article delves into the fundamentals of REIT investing, exploring the various types of REITs, their benefits, and the risks involved. Whether you are a seasoned investor or just beginning to explore real estate investment options, gaining a comprehensive understanding of REITs is essential for making informed investment decisions.

By investing in REITs, individuals can gain exposure to a diverse range of real estate assets, including office buildings, shopping centers, apartments, and warehouses, without the significant capital outlay required for direct ownership. REITs are legally required to distribute a substantial portion of their taxable income to shareholders as dividends, making them an attractive option for income-seeking investors. We will explore the key features of REITs, including their structure, tax implications, and the factors influencing their performance in the real estate market. This comprehensive overview will equip you with the knowledge to evaluate REITs as a potential addition to your investment portfolio.

What Is a REIT?

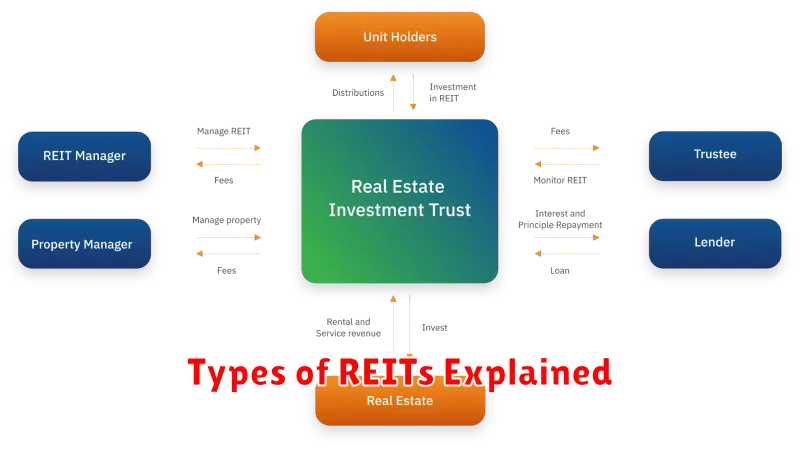

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate. REITs pool the capital of numerous investors to invest in a portfolio of properties or mortgages, providing individuals with an accessible way to invest in real estate without having to directly own, manage, or finance properties themselves. Diversification is a key advantage, as REITs often hold a variety of property types, such as office buildings, apartments, warehouses, retail centers, hotels, and even infrastructure like cell towers and data centers. This diversification helps mitigate risk compared to owning individual properties.

REITs are required by law to distribute a significant portion of their taxable income (generally 90%) to shareholders as dividends. This makes them particularly attractive to income-seeking investors. Liquidity is another benefit, as REIT shares are typically traded on major stock exchanges, offering investors the ability to buy and sell shares readily. This contrasts with the illiquidity often associated with direct real estate ownership.

There are several types of REITs, including equity REITs, which own and operate income-producing real estate; mortgage REITs, which finance real estate; and hybrid REITs, which combine both equity and mortgage investments. REITs are subject to specific regulations and offer a unique combination of dividend income, diversification, and liquidity for investors seeking real estate exposure in their portfolios.

How REITs Make Money

Real Estate Investment Trusts (REITs) primarily generate income through rent collection. They own and operate income-producing real estate, such as office buildings, apartments, shopping malls, and warehouses. By leasing these properties to tenants, REITs receive a steady stream of rental income, which forms the basis of their profits. This income is then distributed to shareholders as dividends, a key attraction of REIT investments.

In addition to rental income, some REITs also profit from property appreciation. As the value of their real estate holdings increases over time, the REIT’s overall net asset value (NAV) grows. This appreciation can be realized when the REIT sells a property, generating capital gains. While not as consistent as rental income, property appreciation contributes to the total return potential of REIT investments.

Finally, certain specialized REITs may engage in other income-generating activities such as property development or financing. These activities, while less common than rental income, can provide additional revenue streams and contribute to overall profitability. However, it is important to note that the core business model for the vast majority of REITs remains centered on collecting rent from owned properties.

Types of REITs Explained

Real Estate Investment Trusts (REITs) offer a way to invest in real estate without directly owning or managing properties. Three main types of REITs exist: Equity REITs, Mortgage REITs, and Hybrid REITs. Equity REITs own and operate income-producing real estate, such as office buildings, shopping malls, and apartments. They generate income primarily through rent collection. Mortgage REITs, on the other hand, provide financing for real estate by purchasing or originating mortgages and mortgage-backed securities. Their income comes primarily from the interest earned on these investments. Finally, Hybrid REITs combine elements of both Equity and Mortgage REITs, investing in both properties and mortgages.

Within these broad categories, REITs can further specialize by property type. Examples include retail REITs focusing on shopping centers, residential REITs investing in apartment buildings, and healthcare REITs specializing in medical facilities. This specialization allows investors to target specific segments of the real estate market. Choosing the right type of REIT depends on individual investment goals and risk tolerance. Equity REITs tend to be less sensitive to interest rate fluctuations than Mortgage REITs, but property values can fluctuate.

By understanding the different types of REITs, investors can make informed decisions about allocating their capital. It is crucial to research specific REITs within each category, considering factors such as management quality, portfolio diversification, and financial performance. REITs can be a valuable part of a diversified investment portfolio, offering potential for both income and long-term growth.

How to Buy and Sell REITs

Real Estate Investment Trusts (REITs) offer a way to invest in real estate without direct property ownership. You can buy and sell REITs much like stocks, through brokerage accounts. Choose a brokerage that aligns with your investment goals and offers access to the REITs you’re interested in. Once your account is funded, you can research and select specific REITs based on factors like property type (e.g., residential, commercial, healthcare), geographic focus, and dividend yield. Then, simply place an order to buy the desired number of shares. Diversification is key, so consider investing in a REIT ETF or a portfolio of individual REITs.

Selling REITs is similarly straightforward. Log into your brokerage account, locate the REIT you wish to sell, and place a sell order. You can specify the number of shares and the price at which you’re willing to sell (a limit order) or sell at the current market price (a market order). Consider factors like market conditions, your investment timeframe, and tax implications when deciding when to sell. Remember that, like stocks, REIT prices fluctuate, so selling at the right time can be important for maximizing returns.

Before investing in REITs, it is crucial to understand the risks. Like any investment, REITs can lose value. Factors like interest rate changes, economic downturns, and oversupply in specific real estate sectors can impact REIT performance. Thorough research and due diligence are essential for making informed investment decisions. Consulting with a financial advisor is also recommended, particularly for those new to REIT investing.

REITs vs Owning Rental Property

Deciding between investing in Real Estate Investment Trusts (REITs) and directly owning rental properties involves weighing different factors. REITs offer liquidity and diversification, allowing investors to easily buy and sell shares in a portfolio of properties without the hands-on management responsibilities. This contrasts with owning rental property, which requires significant capital for down payments and ongoing expenses like repairs and property taxes. Direct ownership, however, gives investors more control over their investment and the potential for higher returns through property appreciation and rental income.

A key difference lies in the level of involvement. REITs are passive investments, similar to stocks, where returns come from dividends and share price appreciation. Managing rental properties, on the other hand, is an active investment. Landlords are responsible for tenant screening, property maintenance, rent collection, and legal compliance. This can be time-consuming and demanding, requiring expertise or the hiring of a property manager.

Ultimately, the best choice depends on individual investment goals and circumstances. Investors seeking passive income with lower capital requirements might prefer REITs. Those willing to put in the time and effort for potentially higher returns and direct control may find owning rental properties more suitable.

Tax Considerations and Dividends

Dividends are payments made to shareholders from a company’s profits. Understanding the tax implications of dividends is crucial for both investors and companies. Qualified dividends are taxed at a lower capital gains rate, while non-qualified dividends are taxed as ordinary income. The qualification status depends on several factors, including the holding period of the stock and the company’s tax status.

For investors, the tax rate on qualified dividends depends on their income bracket. It’s important to consult the current IRS guidelines for specific rates. Companies distributing dividends don’t typically receive a tax deduction, as dividends are paid from after-tax profits. This can influence a company’s decision on whether to distribute earnings as dividends or reinvest them in the business.

Key Considerations:

- Holding period requirements for qualified dividends

- Investor’s income tax bracket

- Company’s tax status and earnings

Risks and Market Volatility

Market volatility refers to the rapid and unpredictable fluctuations in the prices of assets, such as stocks, bonds, and currencies. These fluctuations can be driven by a variety of factors, including economic news, geopolitical events, changes in investor sentiment, and even speculation. Understanding the inherent risks associated with market volatility is crucial for any investor, as it can significantly impact investment returns.

Several key risks are associated with volatile markets. Capital loss is perhaps the most obvious; when markets decline rapidly, investors can experience significant losses on their investments. Liquidity risk can also become a concern during periods of high volatility, as it may become more difficult to buy or sell assets quickly at a desired price. Additionally, volatile markets can lead to increased emotional decision-making, prompting investors to make impulsive choices that may not align with their long-term investment goals.

Managing these risks effectively involves implementing strategies that mitigate potential losses while still allowing for the possibility of gains. Diversification, spreading investments across different asset classes, can help reduce the impact of volatility on a portfolio. Maintaining a long-term perspective is also essential, as short-term market fluctuations are often less significant over the long run. Finally, having a well-defined investment plan with clear objectives and risk tolerance can help investors stay disciplined and avoid emotional reactions to market volatility.

Evaluating REIT Performance

Evaluating Real Estate Investment Trust (REIT) performance requires a multifaceted approach. Funds from Operations (FFO) is a key metric, providing a clearer picture of profitability than net income, as it adds back depreciation and amortization, which are non-cash charges. Other crucial factors include dividend yield, which reflects the return on investment from dividends, and net asset value (NAV), an indicator of the underlying value of the REIT’s holdings. Analyzing occupancy rates, debt levels, and the quality of management also contributes to a comprehensive assessment.

Comparing a REIT’s performance to its peers and relevant benchmarks is essential. Consider the sector-specific performance. For example, a retail REIT might be compared to other retail REITs or a broader retail index. Also, consider the overall market conditions, as macroeconomic factors like interest rates and economic growth can significantly impact REIT performance. Examining the REIT’s historical performance can reveal trends and provide insight into its potential for future growth.

Finally, understanding the REIT’s investment strategy is crucial. Is it focused on growth, aiming for capital appreciation, or income, prioritizing consistent dividend payouts? Knowing the REIT’s objective helps align it with your individual investment goals. Furthermore, consider the geographic diversification and the specific types of properties held within the REIT’s portfolio to evaluate its risk profile and potential for long-term success.

Top REITs to Watch in 2025

Predicting the “top” REITs for any future year is inherently speculative due to market volatility and evolving economic conditions. However, by analyzing current trends and potential future growth areas, we can identify some sectors and REIT characteristics likely to perform well. Investors should research specific REITs within these sectors rather than relying solely on broad categories. Sectors expected to see continued growth include industrial REITs, fueled by e-commerce expansion, and data center REITs, given the ever-increasing demand for data storage and processing. Residential REITs focused on multifamily housing in growing urban areas might also offer strong returns. Beyond sectors, consider factors such as a REIT’s balance sheet strength, management quality, and dividend history.

While the aforementioned sectors show promise, other areas deserve consideration. Healthcare REITs, specifically those focused on senior housing and medical facilities, could benefit from aging demographics. Self-storage REITs continue to perform steadily, providing consistent returns. However, investors should be mindful of potential headwinds such as interest rate fluctuations and oversupply in certain markets. Thorough due diligence is crucial when evaluating any REIT investment.

Finally, remember that past performance is not indicative of future results. Diversification within a real estate portfolio is essential to mitigate risk. Consulting with a qualified financial advisor can help tailor an investment strategy based on individual financial goals and risk tolerance.

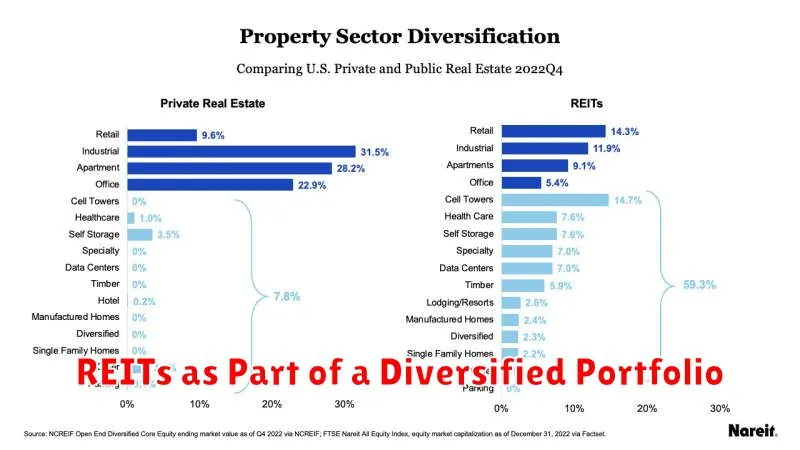

REITs as Part of a Diversified Portfolio

Real Estate Investment Trusts (REITs) can offer investors a way to diversify their portfolios beyond traditional stocks and bonds. REITs are companies that own or finance income-producing real estate across a range of property types, such as office buildings, apartments, warehouses, retail centers, and hotels. By investing in REITs, individuals can gain exposure to the real estate market without the burdens of direct property ownership, like property management and large upfront capital requirements. Diversification is key to managing risk in any investment portfolio, and REITs can play an important role in achieving this balance.

One of the primary advantages of including REITs in a diversified portfolio is their potential to generate consistent income. REITs are legally required to distribute a significant portion of their taxable income as dividends to shareholders. This can provide a steady stream of income for investors, particularly those seeking regular cash flow. Furthermore, REIT returns have historically shown a relatively low correlation with stock and bond returns, meaning they don’t always move in the same direction. This can help to cushion the overall portfolio against market volatility and potentially enhance long-term returns.

While REITs offer several benefits, it’s important to consider potential risks before investing. REIT performance can be affected by changes in interest rates, economic downturns, and fluctuations in the real estate market. Like any investment, conducting thorough due diligence and researching individual REITs or REIT ETFs is crucial. Understanding the specific properties held by a REIT, its management team, and its financial health are essential steps for making informed investment decisions.