Deciding between renting and buying a home is one of the most significant financial decisions you’ll ever make. It’s a complex equation with numerous factors influencing the “smarter” choice, including your financial situation, lifestyle, and market conditions. This comprehensive guide explores the renting vs. buying dilemma, providing valuable insights to help you determine the best path forward for your individual needs. We’ll analyze the pros and cons of each option, empowering you to make an informed decision based on your unique circumstances. Are you ready to delve into the rent vs. buy debate and discover which option aligns best with your long-term goals?

Navigating the complexities of renting versus buying can be challenging. This article will dissect the key aspects of both renting and buying, considering factors such as affordability, investment potential, flexibility, and responsibility. Whether you’re a first-time homebuyer contemplating the plunge into homeownership or a seasoned renter evaluating your long-term housing strategy, understanding the nuances of each choice is crucial. From the initial down payment and mortgage rates to monthly rent and maintenance costs, we’ll cover the essential details to help you navigate the rent vs. buy decision with confidence.

Understanding Your Financial Flexibility

Financial flexibility is the ability to adapt to changing financial circumstances. It represents your capacity to handle unexpected expenses, pursue opportunities, and weather financial storms without significant hardship. Strong financial flexibility often comes from a combination of factors, including having accessible savings, manageable debt levels, and multiple income streams. Being financially flexible provides peace of mind and allows you to confidently navigate life’s uncertainties.

Assessing your financial flexibility involves evaluating your current financial situation. Key indicators include your emergency fund (how many months of expenses it can cover), your debt-to-income ratio (how much of your income goes towards debt repayment), and your liquid assets (cash or investments that can be quickly converted to cash). Analyzing these elements provides a clear picture of your ability to respond to financial challenges and changes.

Improving financial flexibility requires a proactive approach. Prioritize building an emergency fund, ideally enough to cover 3-6 months of essential expenses. Manage your debt effectively by paying down high-interest balances and avoiding unnecessary borrowing. Explore opportunities to diversify your income streams, perhaps through a side hustle or investments. By focusing on these strategies, you can strengthen your financial resilience and prepare yourself for whatever the future may hold.

Benefits of Renting

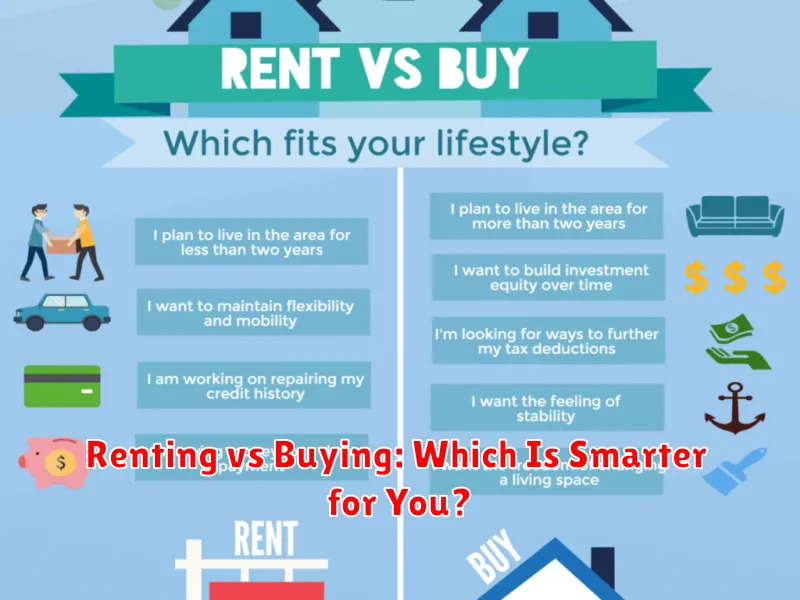

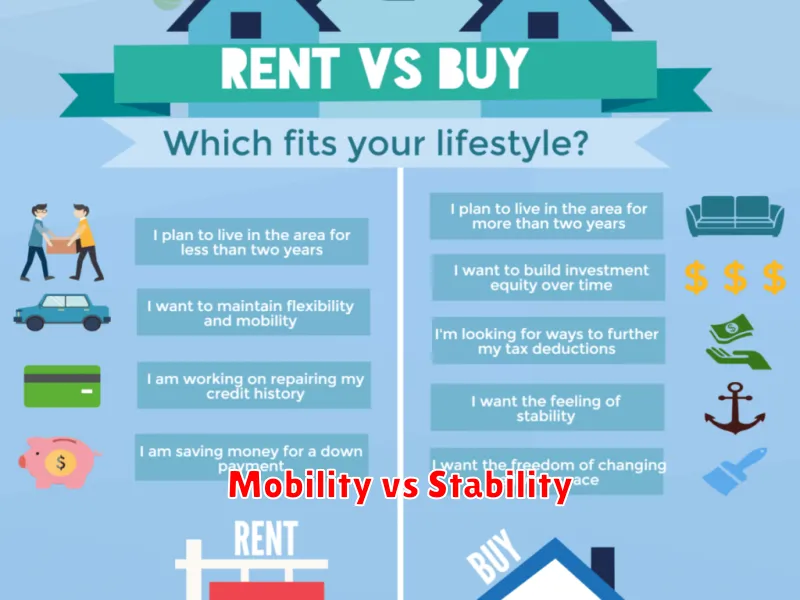

Renting offers a flexible and often more affordable housing option, especially for those who are not ready or willing to commit to homeownership. Renters typically have lower upfront costs, avoiding large down payments, closing costs, and property taxes. This flexibility allows individuals to relocate easily for career opportunities, lifestyle changes, or simply to explore new neighborhoods without the burden of selling a property.

Renters also enjoy the convenience of having many property-related expenses handled by the landlord. This can include maintenance and repairs, landscaping, and sometimes even utilities. This arrangement frees up time and reduces the financial responsibilities often associated with owning a home. This can be particularly attractive for individuals with busy schedules or those who prefer a more predictable monthly housing expense.

Finally, renting can provide access to amenities that may be otherwise unaffordable. Depending on the rental property, these amenities can include swimming pools, fitness centers, laundry facilities, and even concierge services. These added benefits can enhance quality of life and provide a sense of community, all while avoiding the costs associated with owning and maintaining such amenities privately.

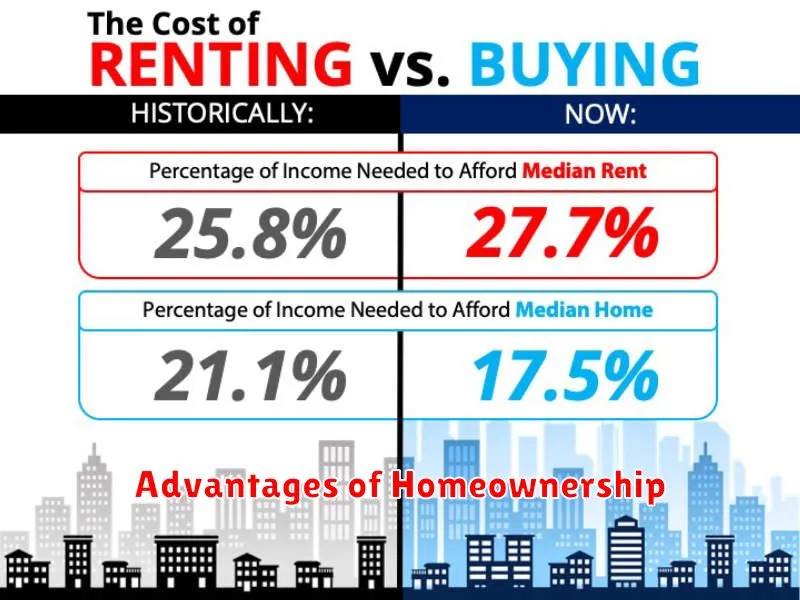

Advantages of Homeownership

Owning a home offers several financial advantages. Building equity is a primary benefit, as your mortgage payments gradually increase your ownership stake, creating a valuable asset over time. Additionally, homeownership offers tax benefits, such as deductions for mortgage interest and property taxes, which can significantly reduce your overall tax burden. Furthermore, a fixed-rate mortgage provides predictable housing expenses, protecting you from rising rent costs and offering long-term budget stability.

Beyond financial gains, homeownership fosters a sense of stability and community. Owning a home provides a sense of permanence and belonging, allowing you to establish roots and become an active member of your local community. It also provides the freedom to personalize and customize your living space to truly reflect your individual style and preferences, something not often possible in rental properties.

Finally, homeownership can be a strong investment. While real estate markets can fluctuate, historically, home values have tended to appreciate over time, providing a hedge against inflation and building long-term wealth. This appreciation can be realized through eventual sale of the property, providing financial security for the future.

Long-Term Cost Comparisons

Conducting long-term cost comparisons requires a comprehensive approach. Key factors to consider include the initial investment, operating expenses, maintenance costs, and potential resale or salvage value. Accurately projecting these costs over the lifespan of an asset or project allows for informed decision-making and effective resource allocation. Hidden costs such as training, integration, and disposal should also be factored into the overall assessment.

Various methods exist for comparing long-term costs. Life-cycle costing (LCC) considers all costs associated with an asset from acquisition to disposal. The Total Cost of Ownership (TCO) model expands on LCC by including indirect costs like productivity losses and downtime. Net Present Value (NPV) analysis discounts future cash flows to their present value, enabling a direct comparison of options with different timelines and cash flow patterns.

Sensitivity analysis is crucial for understanding the impact of uncertain variables on long-term cost projections. By varying key assumptions, such as inflation rates and discount rates, decision-makers can assess the robustness of their cost comparisons and identify potential risks and opportunities. This process allows for more informed decisions and helps mitigate potential financial uncertainties.

Tax Benefits and Implications

Understanding tax benefits and implications is crucial for effective financial planning. Tax benefits can reduce your overall tax burden, increasing your net income. These benefits can come in various forms, such as deductions, credits, and exclusions. For example, deductions reduce your taxable income, while credits directly reduce the amount of tax you owe. It’s important to carefully research and understand which tax benefits you qualify for to maximize your savings.

Conversely, tax implications refer to the potential increase or decrease in taxes resulting from a financial decision. These implications can significantly impact your overall financial outcome. For instance, selling an investment at a profit may trigger capital gains taxes, while certain retirement contributions may offer tax deductions. Therefore, considering the tax implications before making any major financial decision is crucial.

Consulting with a tax professional is often recommended to navigate the complexities of tax benefits and implications. They can provide personalized guidance based on your individual financial situation, ensuring you make informed decisions and optimize your tax strategy.

Lifestyle Considerations

Making significant lifestyle changes requires careful consideration of your current habits and daily routines. Honestly assess your readiness for change and identify potential obstacles. Think about how adjustments might impact your work, relationships, and overall well-being. Starting small and gradually incorporating new habits can be more sustainable than attempting drastic changes all at once.

Support systems play a crucial role in successful lifestyle changes. Talk to friends, family, or a therapist about your goals. Joining a support group or finding a workout buddy can provide accountability and encouragement. Don’t be afraid to ask for help when you need it. Consistency is key, but setbacks are normal. Remember to be kind to yourself throughout the process.

Prioritize changes that align with your values and long-term goals. Focus on making realistic and achievable adjustments rather than chasing quick fixes. For example, if better sleep is your goal, consider establishing a consistent sleep schedule and creating a relaxing bedtime routine. Small, sustainable habits often yield the greatest long-term results.

Mobility vs Stability

Mobility and stability are essential yet contrasting components of human movement. Mobility refers to the ability of a joint to move freely through its intended range of motion. This requires flexibility in the muscles and tissues surrounding the joint. Good mobility allows for effortless movement and reduces the risk of injury. Conversely, stability refers to the ability of a joint to maintain control and resist unwanted movement. This requires strength and coordination in the muscles surrounding the joint, providing a solid foundation for movement.

While seemingly opposing concepts, mobility and stability are interconnected and interdependent. Optimal movement requires a balance of both. A joint that is too mobile may be prone to injury due to lack of control. A joint that is too stable may restrict movement and lead to stiffness. For example, the shoulder joint requires high mobility for activities like throwing or reaching, but it also needs stability to prevent dislocations. Similarly, the hip joint needs both mobility for walking and running and stability for supporting the body’s weight.

Improving both mobility and stability is crucial for overall physical health and performance. This can be achieved through various exercises and stretches targeting specific areas. Addressing any imbalances can help optimize movement, prevent injuries, and improve overall functional fitness.

Interest Rates and Housing Market Trends

Interest rates play a crucial role in shaping housing market trends. When interest rates are low, borrowing becomes cheaper, leading to increased demand for mortgages and subsequently driving up home prices. This often creates a seller’s market, characterized by high demand and limited inventory. Conversely, when interest rates rise, borrowing becomes more expensive, potentially cooling down the housing market by reducing buyer affordability and demand. This can shift the market towards a buyer’s market, with more inventory available and potentially lower prices.

The relationship between interest rates and the housing market isn’t always straightforward. Other factors like the overall economic climate, employment rates, and housing inventory levels can influence market dynamics. For instance, even with low interest rates, a weak economy or high unemployment might suppress housing demand. Similarly, a severe shortage of housing inventory can keep prices high even when interest rates are rising. Understanding these interconnected factors is essential for accurately assessing market trends.

Current market conditions often reflect the interplay of these influences. Careful analysis of interest rate projections, economic indicators, and local market data can provide valuable insight for both buyers and sellers navigating the real estate landscape.

Future Plans and Job Security

Future plans often focus on career advancement, skill development, and increased responsibilities. This can include pursuing further education, seeking mentorship, or actively participating in professional development opportunities. Clearly defined goals and a proactive approach demonstrate a commitment to growth and enhance job security.

Job security is influenced by a variety of factors, including company performance, industry trends, and individual performance. While external factors can play a significant role, employees can improve their own job security by becoming invaluable assets to their organizations. This involves consistently exceeding expectations, adapting to changing circumstances, and developing in-demand skills.

By aligning personal future plans with the organization’s goals and proactively enhancing skills, employees can significantly strengthen their job security and position themselves for long-term success. This proactive approach benefits both the individual and the organization, contributing to a mutually beneficial and stable working relationship.

Making the Best Decision for Your Life

Making good decisions is a crucial life skill. It involves carefully considering your options, weighing the potential outcomes, and choosing the path that aligns best with your values and goals. Sometimes, this means gathering information and seeking advice from trusted sources. Other times, it requires trusting your intuition and taking a calculated risk. Regardless of the approach, the key is to be proactive and thoughtful in your decision-making process.

One effective strategy for making sound decisions is to define the problem or opportunity clearly. Ask yourself what you’re trying to achieve and what factors are most important to consider. Once you have a clear understanding of the situation, brainstorm potential solutions and evaluate their potential benefits and drawbacks. Consider both the short-term and long-term implications of each option. This structured approach can help you avoid impulsive choices and make more informed decisions.

Finally, remember that even the best decisions can sometimes lead to unexpected outcomes. It’s important to be flexible and adaptable, and to be willing to adjust your course if necessary. Learn from your experiences, both positive and negative, and use them to refine your decision-making skills over time. By embracing a continuous learning process, you can improve your ability to make the best decisions for your life.