Purchasing your first home in the US can be both an exciting and daunting experience. Navigating the complex world of mortgages, down payments, home inspections, and real estate agents can feel overwhelming. This guide provides invaluable tips for first-time home buyers in the US, designed to simplify the process and empower you to make informed decisions. We’ll cover everything from understanding your credit score and securing pre-approval to negotiating offers and closing the deal, ensuring you’re well-prepared for this significant milestone.

Whether you’re just starting to dream of homeownership or actively searching for your perfect property, these first-time home buyer tips will equip you with the knowledge and confidence you need. We’ll help you determine your budget, understand different types of mortgages, choose the right real estate agent, and navigate the intricacies of home inspections and appraisals. This guide is your essential resource for a smooth and successful first-time home buying experience in the US.

Save for Down Payment Early

Saving for a down payment on a home is a significant financial undertaking. Starting early allows you to accumulate the necessary funds gradually, reducing the financial strain later. The larger your down payment, the smaller your loan amount will be, which translates to lower monthly mortgage payments and potentially better interest rates. Additionally, a substantial down payment can help you avoid private mortgage insurance (PMI), an added expense for borrowers who put down less than 20%.

There are various strategies to help you save effectively. Create a dedicated savings account specifically for your down payment. Automate regular transfers from your checking account to ensure consistent progress. Explore budgeting apps to track your spending and identify areas where you can cut back. Consider setting realistic savings goals and establish a timeline to stay motivated and focused.

Other helpful tips include setting up automatic escalation for your savings, meaning you increase the amount you save at regular intervals. You might also consider exploring various down payment assistance programs available through government agencies or non-profit organizations. Finally, keep your credit score in good standing as it plays a vital role in securing a mortgage and obtaining favorable terms.

Check Credit Score and Fix Issues

Regularly checking your credit score is crucial for maintaining a healthy financial profile. Understanding your score allows you to assess your creditworthiness and identify potential issues that may be impacting your ability to secure loans, mortgages, or even rent an apartment. Several reputable credit bureaus and online platforms offer free or low-cost access to your credit reports and scores. Reviewing these reports allows you to identify inaccuracies, late payments, or high credit utilization rates that may be negatively affecting your score. Taking proactive steps to address these issues can significantly improve your overall credit health.

Once you have identified any negative factors affecting your credit score, you can begin taking steps to address them. Disputing inaccuracies on your credit report is an important first step. If you find errors, contact the credit bureau directly to initiate the dispute process. For late payments, contact your creditors to discuss potential solutions, such as setting up payment plans or negotiating waivers for late fees. Addressing high credit utilization by paying down balances on your credit cards can also have a positive impact on your score. Building a positive payment history by consistently making on-time payments is essential for long-term credit improvement.

Improving your credit score requires consistent effort and responsible financial management. While some improvements may be seen relatively quickly, rebuilding credit can take time and patience. Continuously monitoring your credit report, paying bills on time, and maintaining a low credit utilization ratio are key factors in building and maintaining a strong credit profile. Remember that a good credit score can open doors to various financial opportunities, so taking the necessary steps to improve and maintain it is a worthwhile investment in your financial future.

Get Pre-Approved by Multiple Lenders

Getting pre-approved by multiple lenders is a crucial step when you’re looking to purchase a home. This process involves submitting loan applications to several lenders to receive estimated loan amounts, interest rates, and terms. By comparing these offers, you can identify the most competitive loan option and strengthen your position when making an offer on a property. Pre-approval provides a clear understanding of your borrowing power and demonstrates your seriousness to sellers, giving you a significant advantage in a competitive market.

It’s important to understand the difference between pre-qualification and pre-approval. Pre-qualification is a less formal assessment based on self-reported information. Pre-approval, on the other hand, involves a thorough review of your credit report and financial documentation, providing a more accurate estimate of your loan eligibility. While it may require more effort upfront, pre-approval carries significantly more weight with sellers and can streamline the home-buying process.

When seeking pre-approval from multiple lenders, be mindful of the impact on your credit score. Multiple hard inquiries within a short period can slightly lower your score. However, most credit scoring models recognize that multiple mortgage inquiries within a specific timeframe (typically 14-45 days) are related to a single loan search. By completing your lender search within this window, you can minimize the potential impact on your credit.

Understand All Costs of Ownership

Comprehending the total cost of ownership (TCO) is crucial for making informed financial decisions. TCO goes beyond the initial purchase price and encompasses all expenses associated with owning and operating an asset over its entire lifespan. This includes not only the purchase price, but also factors such as maintenance, repairs, operating costs (like fuel or electricity), and even disposal fees. Accurately calculating TCO provides a more realistic picture of the long-term financial commitment.

For example, when considering a car, the TCO would include expenses beyond the sticker price, such as insurance premiums, fuel costs, regular maintenance (oil changes, tire rotations), potential repair costs, and eventual resale value. For a business investing in new equipment, TCO might involve installation costs, employee training, software licenses, and ongoing maintenance contracts. By considering these additional expenses, you can avoid unexpected financial burdens and make more strategic decisions.

Failing to consider TCO can lead to significant financial missteps. A less expensive initial purchase may end up costing more in the long run if it requires frequent repairs or has high operating costs. By evaluating TCO, individuals and businesses can compare different options and choose the most cost-effective solution over the long term, not just the cheapest upfront option. This comprehensive approach to cost analysis fosters better financial planning and more sustainable investments.

Work With a Real Estate Agent

A real estate agent brings expertise and market knowledge to your property transaction. They can help you determine a fair market price for your property, whether you’re buying or selling. Agents also handle the complex paperwork, negotiations, and legal details involved in a real estate deal, saving you time and potential stress. Their network of contacts can also prove invaluable, connecting you with mortgage brokers, inspectors, and other professionals needed throughout the process.

When choosing an agent, consider their experience, local market knowledge, and communication style. Look for an agent who actively listens to your needs and keeps you informed throughout the process. Don’t hesitate to interview multiple agents before making a decision. Ask about their track record, their approach to marketing (if selling), and their availability to address your questions and concerns.

Working with a real estate agent can significantly simplify the often overwhelming process of buying or selling property. Their professional guidance can help you navigate the market effectively and achieve your real estate goals with greater confidence. While there are fees involved, the benefits of having an experienced professional on your side can often outweigh the costs.

Avoid Emotional Buying Decisions

Making purchasing decisions based on emotions can lead to buyer’s remorse and financial strain. Impulse buys, driven by feelings of excitement, sadness, or stress, often result in acquiring items we don’t truly need or can’t afford. It’s crucial to recognize emotional triggers and develop strategies to avoid making rash decisions.

Before making a purchase, especially a significant one, take a step back and assess your emotional state. Are you feeling pressured by a salesperson or swayed by clever marketing tactics? Ask yourself if you truly need the item and how it aligns with your budget and overall financial goals. Consider delaying the purchase for a set period, like 24 hours, to allow time for rational thinking to prevail. This cooling-off period can help you determine if the purchase is a genuine need or a fleeting desire.

Creating a budget and sticking to it is a powerful tool in avoiding emotional spending. A budget provides a clear picture of your finances and helps you prioritize spending. When faced with a tempting purchase, refer to your budget to see if it aligns with your financial plan. If not, walking away is the smartest choice. Remember, delaying gratification and making informed purchasing decisions are key to achieving long-term financial well-being.

Inspect the Property Thoroughly

A thorough inspection is crucial before making an offer on a property. Carefully examine the interior and exterior for any signs of damage, wear and tear, or potential problems. Pay close attention to the condition of the roof, foundation, plumbing, electrical systems, and HVAC. Document any issues you find with photos and notes, as this information can be valuable during price negotiations or when deciding whether to proceed with the purchase.

Don’t hesitate to ask questions and seek clarification on anything that seems unclear or concerning. If you’re not experienced in home inspections, consider hiring a professional inspector. Their expertise can help identify hidden problems that you might miss and provide a detailed report on the property’s condition. This small investment can save you significant money and headaches in the long run.

Key areas to focus on include:

- Structural integrity: Look for cracks in walls, uneven floors, and signs of settling.

- Water damage: Check for stains, mold, and mildew, especially in bathrooms, kitchens, and basements.

- Pest infestations: Look for signs of insects or rodents.

- Functionality of appliances: Test all appliances to ensure they are in working order.

Compare Neighborhoods and School Zones

Choosing the right neighborhood and school zone is a critical decision for families. Factors to consider include housing costs, commute times, safety, amenities, and of course, school quality. Researching these aspects thoroughly is essential for finding the best fit for your family’s needs and lifestyle. Begin by identifying your priorities and budget. Then, explore different neighborhoods, comparing their features and how they align with your requirements.

School zones often play a significant role in a family’s decision-making process. Look beyond test scores and rankings. Consider factors such as class size, extracurricular activities, teacher-student ratios, and the overall school environment. Visiting schools and attending open houses can provide valuable insights. Talking to current parents and students can also offer a firsthand perspective on the school community.

Utilizing online resources can streamline your research process. Many websites offer data and reviews on neighborhoods and schools. Create a comparison chart to organize your findings and easily weigh the pros and cons of each area. Remember to consider both your current and future needs when making this important decision.

Understand Tax Breaks for New Homeowners

Becoming a homeowner often comes with significant financial benefits, particularly in the form of tax breaks. One of the most valuable deductions is for mortgage interest. You can typically deduct the interest paid on the first $750,000 of your mortgage debt (or $375,000 if married filing separately). This can significantly reduce your taxable income, especially in the early years of your mortgage when interest payments are highest. Additionally, you can deduct points paid at closing, which are essentially prepaid interest, and property taxes, further lowering your overall tax burden.

It’s also important to be aware of other potential tax benefits related to homeownership. For example, if you used funds from a traditional IRA for a first-time home purchase, you can withdraw up to $10,000 penalty-free, although you will still owe income tax on the withdrawal. Also, capital gains exclusions can be significant when you sell your home. If you’ve lived in the home for at least two of the five years leading up to the sale, you can exclude up to $250,000 of profit ($500,000 if married filing jointly) from capital gains taxes. This exclusion can be a major advantage when selling a home that has appreciated significantly in value.

Navigating these tax breaks can be complex, so consulting with a qualified tax advisor is highly recommended. They can provide personalized guidance based on your specific situation and ensure you’re taking advantage of all applicable deductions and exclusions. This is especially important during the first year of homeownership when you’re adapting to new financial responsibilities. Keeping accurate records of all home-related expenses is crucial to maximizing your tax benefits.

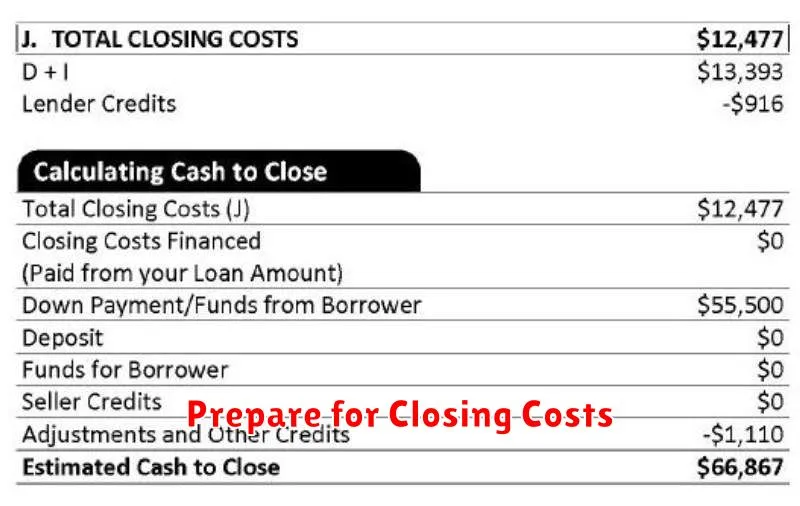

Prepare for Closing Costs

Closing costs are the expenses, beyond the property’s price, that buyers and sellers pay to finalize a real estate transaction. These costs can vary, but typically range from 2% to 5% of the purchase price. It’s crucial to budget for these expenses to avoid surprises at the closing table. Common closing costs include lender fees, appraisal fees, title insurance, and government recording fees.

Buyers typically pay the majority of closing costs, although some may be negotiable with the seller. Being aware of these potential costs early in the home-buying process will help you prepare financially. You can ask your lender for a loan estimate which will outline the anticipated costs. Carefully reviewing this document will help you understand what you’ll need to pay.

By understanding and preparing for closing costs, you can avoid financial stress and ensure a smoother closing process. Make sure to save diligently and factor these costs into your overall budget. Consulting with a real estate professional can also provide valuable insights into expected closing costs in your area.