Looking to buy your dream home but worried about mortgage approval? Securing a mortgage can feel daunting, but understanding the key factors lenders consider can significantly improve your mortgage approval chances. This article will provide actionable steps to strengthen your application and increase the likelihood of a successful mortgage approval. We’ll explore how optimizing your credit score, managing your debt-to-income ratio, and demonstrating stable income can make you a more attractive borrower. Learn how to navigate the mortgage process with confidence and improve your mortgage approval odds.

From understanding the importance of a substantial down payment to presenting a clear and organized application, we’ll cover the essential elements that lenders scrutinize. Whether you’re a first-time homebuyer or looking to refinance, improving your mortgage approval chances starts with informed preparation. This guide will empower you with the knowledge and strategies to present a compelling case to lenders, increasing your chances of securing the mortgage you need to purchase your new home. Let’s explore how to make your homeownership dreams a reality by boosting your mortgage approval potential.

Understand Your Credit Score

Your credit score is a numerical representation of your creditworthiness, summarizing your credit history into a three-digit number. Lenders use this score to assess the risk of lending you money. A higher score generally indicates responsible credit behavior and makes you a more attractive borrower, potentially qualifying you for better loan terms and lower interest rates.

Several factors influence your credit score. Payment history is the most significant, demonstrating your ability to make timely payments. Amounts owed, reflecting your credit utilization ratio, also plays a crucial role. The length of your credit history, credit mix (variety of credit accounts), and new credit inquiries also factor into the calculation.

Understanding your credit score is crucial for managing your finances effectively. Regularly checking your score allows you to identify potential errors and take steps to improve your credit health. This can lead to more favorable financial outcomes, including access to better loan options and lower insurance premiums.

Reduce Existing Debt First

Before embarking on new investments, it’s crucial to prioritize reducing existing high-interest debt. High-interest debt, such as credit card balances, can significantly impede your financial progress. The interest payments consume a large portion of your potential investment returns, making it harder to build wealth. Aggressively paying down these debts first frees up more of your income for future investments and reduces the overall financial burden.

Consider various debt reduction strategies like the debt snowball or debt avalanche methods. The debt snowball focuses on paying off the smallest debts first for psychological momentum, while the debt avalanche prioritizes the debts with the highest interest rates to minimize the total interest paid. Choosing the right strategy depends on your individual financial situation and personality.

Once you’ve significantly reduced or eliminated high-interest debt, you’ll be in a stronger financial position to begin investing. With less debt burdening your income, you can allocate more funds towards investments, maximizing your potential for long-term growth and financial security.

Avoid Big Purchases Before Applying

Making large purchases, such as a new car or furniture, before applying for a loan can significantly impact your application’s success. These purchases often involve taking on new debt, which increases your debt-to-income ratio. A higher debt-to-income ratio suggests to lenders that you have less disposable income available to make loan repayments. This can make you appear as a higher risk borrower, potentially leading to a loan denial or higher interest rates.

Furthermore, large purchases can negatively affect your credit score, especially if they require opening new credit accounts. New credit inquiries can lower your score, and a lower score further reduces your chances of loan approval at favorable terms. It’s crucial to maintain a healthy credit score and debt-to-income ratio when seeking financing. Therefore, it’s wise to postpone significant purchases until after your loan application is approved and the funds are secured.

Instead of focusing on large purchases, prioritize improving your financial standing before applying. Consider paying down existing debts to lower your debt-to-income ratio and demonstrate responsible financial management. Also, avoid opening any new credit accounts unless absolutely necessary. These steps will strengthen your loan application and increase your chances of approval at the best possible terms.

Save for a Bigger Down Payment

Saving for a larger down payment on a home offers several significant advantages. A larger down payment reduces the loan amount, which translates to lower monthly mortgage payments. This can free up funds in your budget for other expenses or investments. Furthermore, a larger down payment can often lead to a lower interest rate on your mortgage, saving you money over the life of the loan. It also helps you avoid private mortgage insurance (PMI), typically required if your down payment is less than 20% of the home’s purchase price.

There are various strategies you can employ to effectively save for a larger down payment. Creating and sticking to a budget is essential to track your spending and identify areas where you can cut back. Consider setting up a separate savings account specifically dedicated to your down payment funds. Automating regular transfers from your checking account to this savings account can make saving consistent and effortless. Exploring options like selling unwanted items, taking on a side hustle, or negotiating a raise can also help accelerate your savings progress.

Finally, remember to be patient and realistic throughout the saving process. Building a substantial down payment takes time and discipline. Set achievable goals and celebrate your milestones along the way. Consulting with a financial advisor can provide personalized guidance and help you develop a tailored savings plan that aligns with your specific financial situation and homeownership goals.

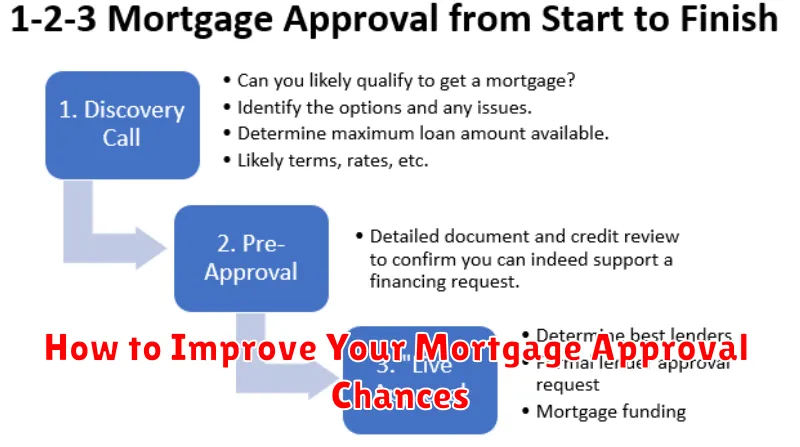

Get Pre-Approved to Know Your Range

Getting pre-approved for a mortgage is a crucial first step in the home-buying process. It provides you with a realistic budget by determining how much a lender is willing to loan you. This allows you to shop for homes confidently, knowing your price range and avoiding disappointment later. A pre-approval also strengthens your offer, showing sellers you’re a serious and qualified buyer.

The pre-approval process typically involves providing a lender with your financial information, including income, debt, and credit history. The lender will then review your information and issue a pre-approval letter stating the loan amount you’re eligible for. Keep in mind that a pre-approval is not a guarantee of a loan, but it’s a strong indicator of your borrowing power.

By taking the time to get pre-approved, you’ll gain a significant advantage in the competitive real estate market. You’ll be able to focus your search, make informed decisions, and present yourself as a prepared and qualified buyer. This will make your home-buying journey smoother and more efficient.

Compare Lenders and Interest Rates

Comparing lenders and interest rates is crucial when borrowing money. Different lenders offer varying interest rates, fees, and loan terms. Carefully examining these factors will help you secure the most favorable loan for your needs. Consider factors like APR (Annual Percentage Rate), which reflects the total cost of borrowing, including interest and fees. Also, be sure to compare loan origination fees, prepayment penalties, and the overall repayment schedule.

You can compare lenders through online marketplaces, financial institutions’ websites, and independent comparison tools. Be sure to check the lender’s reputation and read customer reviews before making a decision. Understanding each lender’s specific requirements and eligibility criteria is also important. Don’t hesitate to contact lenders directly to ask questions and clarify any concerns.

Shopping around for the best interest rates can significantly impact your long-term financial health. Even a small difference in interest rates can save you a substantial amount of money over the life of the loan. Therefore, taking the time to compare lenders and interest rates is a worthwhile investment.

Limit Credit Inquiries

Credit inquiries, also known as credit checks, occur when a lender or other entity reviews your credit report. These inquiries can slightly lower your credit score, especially if you have numerous inquiries in a short period. There are two main types of inquiries: hard inquiries and soft inquiries. Hard inquiries occur when you apply for credit, such as a loan or credit card. Soft inquiries occur when your credit is checked for reasons other than a credit application, such as pre-approved offers or employment background checks. It’s the hard inquiries that can impact your credit score.

To limit the negative impact of credit inquiries, it’s wise to be strategic about your credit applications. Avoid applying for multiple credit products within a short timeframe, especially within a year. Before applying for any credit, consider checking your own credit report for free, so you are aware of your current credit standing. This allows you to identify any errors and make informed decisions about applying for new credit.

Monitoring your credit report regularly is crucial. By staying informed about your credit activity, you can detect any unauthorized inquiries and take appropriate action to address them. Utilizing free credit monitoring tools and reviewing your credit report at least annually can help you stay on top of your credit health and limit the impact of inquiries.

Ensure Stable Income Documentation

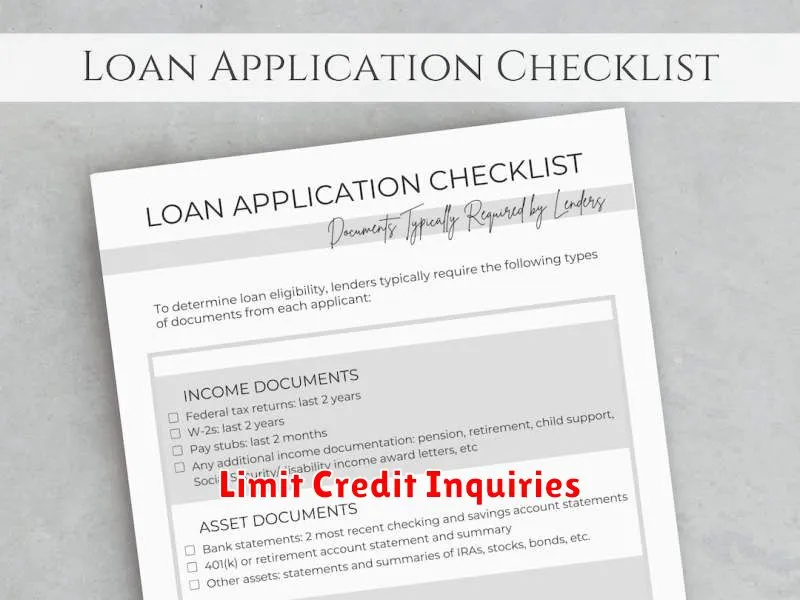

Verifying stable income is a crucial step in many financial processes, such as loan applications, rental agreements, and even some employment opportunities. Providing complete and accurate documentation is key to a smooth and successful process. This means gathering the right documents that clearly demonstrate your consistent income stream.

Commonly accepted documents include pay stubs covering a recent period (e.g., the last 30 days), W-2 forms for the past two years, tax returns (personal and/or business), and bank statements. If you’re self-employed or receive income from other sources like investments or social security, additional documentation may be required such as 1099 forms, profit and loss statements, or benefit award letters. Be prepared to provide these upon request.

Organize your documents beforehand for easy access. Having everything readily available will expedite the process and demonstrate your preparedness. It’s also wise to keep copies of everything you submit for your own records. If there are any discrepancies or questions about your income, be prepared to address them promptly and provide clarifying information.

Be Transparent With Your Financial History

Transparency about your financial history is crucial, especially when dealing with lenders, investors, or potential business partners. Openly sharing relevant information, such as credit scores, past bankruptcies, or significant debts, builds trust and allows others to accurately assess the risks involved. While some aspects of your financial history might be less than ideal, honesty and forthrightness are always appreciated and often lead to better outcomes. Being upfront prevents misunderstandings and potential problems down the road.

Providing context around past financial challenges is often helpful. For instance, if you experienced a period of unemployment that led to missed payments, explaining the situation demonstrates responsibility and a willingness to learn from past experiences. Focus on the steps you’ve taken to improve your financial situation, such as debt repayment plans or improved budgeting practices. This demonstrates your commitment to responsible financial management.

Being transparent doesn’t mean divulging every single financial detail. Focus on providing the information relevant to the situation. If you’re applying for a loan, the lender will primarily be interested in your credit history and income. If you’re seeking investment, details about your business finances and past performance will be more important. Tailor your disclosure to the specific needs of the audience while maintaining honesty and accuracy.

Work With a Mortgage Broker if Needed

Navigating the mortgage landscape can be complex. If you’re feeling overwhelmed by the options, consider working with a mortgage broker. Brokers act as intermediaries between borrowers and lenders, helping you find the best mortgage product for your individual needs. They can compare rates from multiple lenders, saving you time and potentially money. A broker can also be particularly helpful for those with complex financial situations or those seeking niche loan products.

While brokers can be a valuable resource, it’s important to understand how they are compensated. Typically, brokers receive a commission from the lender once the loan closes. This commission is usually a percentage of the loan amount. Be sure to ask about fees and commission structures upfront to ensure transparency. Also, remember to compare the deals offered by brokers with those you can find directly from lenders. Doing your own research can help you determine if you’re getting the most competitive rate.

Finally, choose a broker who is licensed and reputable. Ask for referrals from friends or family, and check online reviews. A good broker will take the time to understand your financial goals and guide you through the entire mortgage process, from pre-approval to closing. By asking the right questions and doing your due diligence, you can find a broker who is the right fit for your needs and help you secure the best possible mortgage.