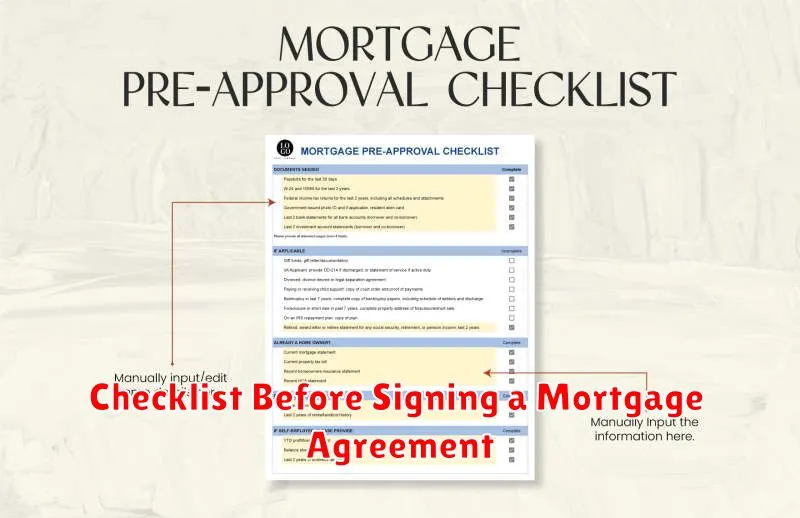

Signing a mortgage agreement is a significant financial commitment. Before you put pen to paper, it’s crucial to thoroughly understand the terms and conditions of your mortgage. This checklist will guide you through the essential steps to take before signing a mortgage agreement, empowering you to make an informed decision and avoid potential pitfalls. Taking the time to review these critical points will protect your financial future and ensure a smooth home buying process. We’ll cover everything from interest rates and closing costs to prepayment penalties and escrow accounts, providing a comprehensive overview of what you need to know before signing on the dotted line. Are you ready to confidently navigate the complexities of a mortgage agreement? This checklist will equip you with the knowledge and confidence you need to make the best decision for your financial well-being.

Navigating the mortgage process can feel overwhelming, but understanding key elements like mortgage rates, closing costs, and loan terms is paramount. This checklist will break down the essential aspects of a mortgage agreement, highlighting crucial details to review before committing to a loan. We’ll delve into prepayment penalties, escrow accounts, and other important factors that can significantly impact your finances. By utilizing this checklist, you can ensure a thorough understanding of your mortgage agreement, empowering you to make a sound and informed decision. Don’t sign that mortgage agreement until you’ve carefully considered every aspect of this important financial commitment.

Understand Your Loan Type

Knowing your loan type is crucial for effective financial planning. Different loans have different terms, interest rates, and repayment schedules. Understanding these differences allows you to make informed decisions and choose the loan that best suits your needs. Before committing to any loan, carefully review the terms and conditions to ensure you comprehend the implications and obligations.

Common loan types include secured loans, which require collateral, and unsecured loans, which do not. Mortgages and auto loans are examples of secured loans, while personal loans and credit cards are examples of unsecured loans. Student loans are another common type, often with specific repayment options depending on the loan program. The interest rates and repayment terms vary significantly between these loan types, influenced by factors such as credit score and market conditions.

By diligently researching and understanding the nuances of each loan type, you can make responsible financial decisions and avoid potential pitfalls. Consider factors such as the annual percentage rate (APR), the total cost of the loan, and the repayment period. Comparing offers from multiple lenders can also help you secure the most favorable terms. A clear understanding of your loan will contribute to your overall financial well-being.

Clarify the Interest Rate Structure

An interest rate structure describes the relationship between the various interest rates offered on debt instruments with different maturities, credit risks, and other characteristics. Understanding this structure is crucial for making informed investment and borrowing decisions. It helps investors evaluate potential returns and manage risks associated with interest rate fluctuations, while also enabling borrowers to secure financing at the most favorable terms.

A key component of the interest rate structure is the yield curve, which plots the yields of similar quality bonds against their time to maturity. Typically, a normal yield curve slopes upwards, indicating that longer-term bonds offer higher yields than shorter-term bonds. This reflects the greater risk associated with lending money for extended periods. Conversely, an inverted yield curve, where short-term yields are higher than long-term yields, is often seen as a leading indicator of a potential economic recession. Other variations include flat and humped yield curves, each with its own implications.

Beyond the yield curve, the interest rate structure also considers the impact of credit risk, liquidity, and other factors. Credit risk, the risk that a borrower may default, plays a significant role in determining interest rates. Borrowers with higher credit ratings generally receive lower interest rates than those with lower ratings. Liquidity, the ease with which an asset can be bought or sold, also impacts rates. Less liquid assets often command higher yields to compensate investors for the difficulty of selling them quickly.

Confirm Total Loan Amount and Term

Please carefully review and confirm the following loan details. It is crucial that this information is accurate before proceeding. If any adjustments are needed, please contact your loan officer immediately.

Your total loan amount is $XXX,XXX.XX and the loan term is XX years. This includes all applicable fees and charges, as detailed in your loan agreement. Ensure these figures align with your expectations and financial capabilities.

Upon confirmation, you are acknowledging your understanding and acceptance of these terms. By clicking “Confirm,” you agree to proceed with the loan process under the specified amount and term.

Review Monthly Payment Obligations

Regular review of monthly payment obligations is crucial for maintaining financial stability and achieving financial goals. This process involves carefully examining all recurring expenses, including loan payments (mortgage, auto, student loans), rent, utilities, subscriptions, and other recurring bills. Understanding where your money is going allows you to identify areas for potential savings, prioritize essential expenses, and ensure you are staying within your budget.

By actively reviewing your monthly obligations, you can proactively address potential financial challenges. For example, if you anticipate a change in income or a significant upcoming expense, understanding your current payment obligations allows you to adjust your spending accordingly and avoid falling behind on payments. This review also provides an opportunity to assess the value received for each expense. Are there subscriptions you no longer use? Can you negotiate lower rates for certain services? Asking these questions can lead to significant savings over time.

A structured approach to reviewing monthly obligations can be beneficial. Consider creating a spreadsheet or using a budgeting app to track your expenses. This can help you visualize your spending patterns and identify areas where you can reduce costs. Regular review, ideally monthly, can help you stay on top of your finances and make informed decisions about your spending.

Ask About Prepayment Penalties

Prepayment penalties are fees charged by some lenders if you pay off your loan early, either through extra payments or refinancing. These penalties can be significant, sometimes costing thousands of dollars, and can offset the benefits of refinancing or paying down your loan quickly. It’s crucial to understand if your loan includes a prepayment penalty before signing any paperwork.

Lenders use these penalties to protect their projected earnings from interest. By paying off your loan early, you deprive them of that income. While prepayment penalties are becoming less common, they are still found in some mortgages, auto loans, and personal loans. Be sure to ask specifically if a prepayment penalty applies and, if so, under what conditions and for what amount.

If your current loan has a prepayment penalty and you’re considering refinancing, carefully calculate whether the potential savings outweigh the penalty cost. Consider factors like the new interest rate, the remaining term of your loan, and the amount of the penalty itself. Don’t hesitate to negotiate with your lender to waive or reduce the penalty, especially if you’ve been a long-term customer in good standing.

Check the Total Cost Over Loan Life

Before committing to a loan, it’s crucial to understand the total cost over the loan’s life. This goes beyond just the principal amount borrowed. The total cost includes the principal plus all interest accrued, as well as any additional fees like origination fees, prepayment penalties, or late payment charges. Calculating this total cost allows you to accurately compare loan offers and make an informed borrowing decision.

A simple way to calculate the total cost is to multiply your monthly payment by the total number of payments. For example, if your monthly payment is $500 and the loan term is 60 months (5 years), your total cost would be $30,000. Subtract the principal borrowed from this figure to determine the total interest paid. Comparing the total interest paid across different loan offers will highlight which loan is truly the most cost-effective, even if monthly payments appear similar.

Don’t hesitate to use online loan calculators or consult with a financial advisor. Understanding the long-term cost of borrowing is essential for responsible financial planning.

Understand Escrow and Insurance Payments

Escrow accounts are commonly used in real estate transactions to hold funds for property taxes and insurance premiums. Your lender collects a portion of these costs with your monthly mortgage payment and deposits it into the escrow account. When these bills are due, the lender pays them directly from the escrow account on your behalf. This system helps ensure that these essential payments are made on time, protecting both you and the lender’s investment in the property.

The amount collected for escrow can fluctuate. Initially, the lender estimates the annual costs for taxes and insurance. As these costs can change, the lender typically reviews the escrow account annually and adjusts the monthly collection amount accordingly. You may receive an escrow analysis statement that details these changes. If the account has a surplus, you may receive a refund. Conversely, if there’s a shortage, you may need to pay additional funds to cover the deficit.

While escrow accounts are often required for mortgages with a down payment of less than 20%, some borrowers with larger down payments opt to pay their taxes and insurance directly. However, using an escrow account simplifies the process and ensures timely payment, minimizing the risk of penalties or lapses in coverage. Understanding how escrow accounts function is essential for managing your mortgage and protecting your investment.

Request a Copy of Loan Estimate

A Loan Estimate is a crucial document providing a detailed breakdown of the costs and terms associated with your mortgage. It allows you to compare loan offers from different lenders and make an informed decision. If you’ve misplaced your original Loan Estimate or never received one, contacting your lender directly is the most efficient way to obtain a copy. Be prepared to provide your loan number and other identifying information to expedite the process.

You can typically request the Loan Estimate via phone, email, or through your lender’s online portal, if available. Be sure to keep the copy in a safe place for future reference, especially as you navigate the closing process. This document outlines key information such as your loan amount, interest rate, closing costs, estimated monthly payments, and potential risks.

Understanding the details within your Loan Estimate is essential for responsible homeownership. Reviewing it carefully will help you avoid surprises and ensure you’re comfortable with the terms of your mortgage. If anything is unclear, don’t hesitate to ask your lender for clarification.

Verify Disclosures and Fees

Before making any financial decisions, it’s crucial to thoroughly review all disclosures and associated fees. This includes understanding the terms and conditions of any loans, investments, or services you are considering. Carefully examine the fine print for details about interest rates, penalties, and any other potential costs. This will help you make informed decisions and avoid unexpected expenses.

Pay close attention to key terms like APR (Annual Percentage Rate), origination fees, late payment penalties, and prepayment penalties. Comparing these fees across different providers is essential to securing the most favorable terms. Don’t hesitate to ask questions if anything is unclear – a reputable financial institution should be transparent and willing to explain all aspects of their products and services.

Taking the time to verify disclosures and fees upfront can save you significant money and headaches in the long run. It empowers you to make sound financial choices that align with your goals and budget.

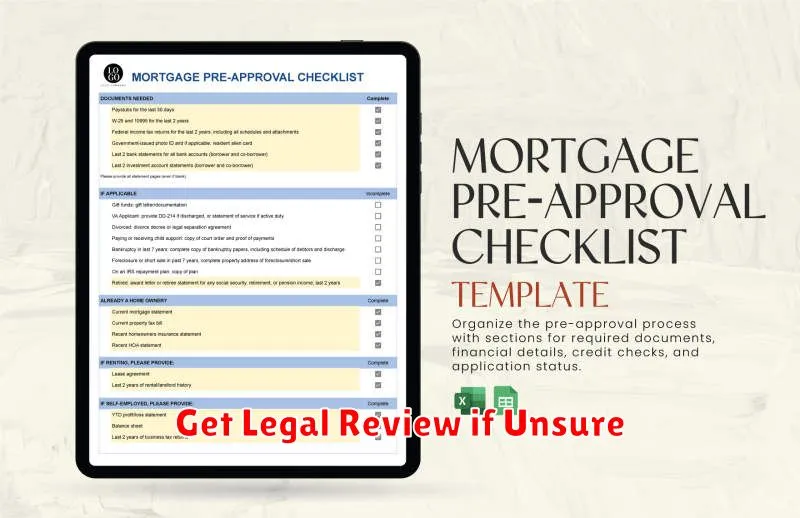

Get Legal Review if Unsure

Navigating legal matters can be complex, and it’s often difficult to understand the nuances of the law and how they apply to your specific situation. When faced with legal questions or uncertainties, seeking advice from a qualified legal professional is crucial. They can provide clarity on your rights and obligations, helping you make informed decisions and avoid potential pitfalls.

A legal review can offer essential support in various situations, such as reviewing contracts, understanding employment rights, navigating family law matters, or addressing property disputes. Attorneys possess the expertise to interpret legal documents, assess the strengths and weaknesses of your case, and advise you on the best course of action. Don’t underestimate the value of professional legal guidance when dealing with important matters.

Attempting to resolve legal issues without professional help can lead to costly mistakes and unintended consequences. While it might seem tempting to save money by handling things yourself, the long-term implications of an incorrect decision can far outweigh the initial cost of legal consultation. Protect yourself and your interests by seeking a legal review when you’re unsure about how to proceed.