Determining your true home affordability is a crucial first step in the home-buying process. It goes beyond simply getting pre-approved for a mortgage. Calculating home affordability involves a comprehensive assessment of your financial situation, including not just your income and debts, but also your lifestyle, saving goals, and anticipated future expenses. Understanding your true affordability helps you avoid the pitfalls of being house poor, ensuring you can comfortably afford your home and maintain your desired lifestyle.

This guide will provide you with a detailed methodology for calculating your true home affordability. We’ll cover key factors like determining your debt-to-income ratio (DTI), understanding the impact of property taxes, homeowners insurance, and private mortgage insurance (PMI), as well as factoring in costs like maintenance and potential HOA fees. By following these steps, you can confidently determine a realistic budget for your home purchase and embark on your house hunting journey with a clear understanding of your financial capacity.

Why Home Affordability Matters

Home affordability is a crucial element of a healthy economy and a stable society. It directly impacts individuals’ and families’ ability to access safe and adequate housing, a fundamental human need. When housing costs consume a disproportionate share of income, it strains household budgets, limiting spending on other essentials like food, healthcare, and education. This can lead to financial instability, increased stress, and reduced overall well-being. Furthermore, widespread unaffordability can contribute to broader economic challenges, such as reduced consumer spending and slower economic growth.

Beyond the individual level, accessible housing promotes community stability and fosters a sense of belonging. When people can afford to live in the communities where they work and socialize, it strengthens social connections and supports local businesses. Affordable housing also allows individuals to invest in their futures, whether it’s pursuing higher education, starting a family, or saving for retirement. Without the burden of excessive housing costs, people have greater opportunities to build wealth and achieve their financial goals.

Addressing home affordability requires a multi-faceted approach involving government policies, private sector initiatives, and community engagement. Strategies can include increasing the supply of affordable housing units, providing financial assistance to homebuyers, promoting responsible lending practices, and investing in infrastructure to support sustainable community development. By prioritizing home affordability, we can create stronger, more resilient communities and ensure that everyone has the opportunity to live in a safe, stable, and affordable home.

Understand Your Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is a crucial financial metric that lenders use to assess your ability to manage debt. It’s calculated by dividing your total monthly debt payments by your gross monthly income. A lower DTI demonstrates responsible debt management and a higher likelihood of repaying loans, while a higher DTI suggests potential difficulty managing debt obligations. Understanding your DTI is essential for obtaining credit, securing favorable loan terms, and managing your overall financial health.

There are two main types of DTI ratios. The front-end DTI considers only housing-related expenses, such as mortgage payments, property taxes, and homeowner’s insurance, divided by your gross monthly income. The back-end DTI, which is generally more important to lenders, encompasses all recurring monthly debt payments, including housing costs, credit card payments, student loans, auto loans, and personal loans, also divided by your gross monthly income.

Improving your DTI typically involves either increasing your income or decreasing your debt. Strategies to lower your DTI include paying down high-interest debt, consolidating debt, creating a realistic budget, and avoiding taking on new debt. Regularly monitoring and managing your DTI can significantly impact your financial well-being and access to credit.

Include All Monthly Expenses

Creating a comprehensive monthly budget requires diligently tracking all expenses. This includes not only obvious costs like rent or mortgage payments, car payments, and utilities, but also less frequent or variable expenses. Consider recurring subscriptions (streaming services, gym memberships), groceries, transportation costs (fuel, public transit), personal care items, and entertainment. Accurately capturing all expenditures, even small ones, provides a realistic picture of your spending habits and allows for better financial planning.

Categorizing expenses can be beneficial in identifying areas where spending can be adjusted. Broad categories such as housing, transportation, food, and entertainment can be further broken down into more specific areas. For example, “food” could include groceries, dining out, and work lunches. This level of detail allows for a more granular analysis of spending patterns and helps identify potential areas for savings. Tracking expenses consistently throughout the month, whether through a budgeting app, spreadsheet, or notebook, is crucial for maintaining an accurate budget.

Beyond regular monthly expenses, remember to account for irregular or periodic expenses. These might include annual insurance premiums, holiday gifts, or car maintenance. One approach is to set aside a portion of your budget each month to cover these anticipated costs when they arise. This proactive approach prevents financial strain and promotes better long-term budget management.

Estimate Property Taxes and Insurance

Estimating property taxes and insurance is crucial when budgeting for a home purchase. Property taxes are typically calculated based on the assessed value of your property, which is determined by your local government. Rates vary significantly by location and are used to fund local services like schools and infrastructure. Contacting the local tax assessor’s office is the best way to get an accurate estimate for a specific property.

Homeowners insurance protects your property against damage or loss from covered perils such as fire, theft, and certain natural disasters. Factors influencing insurance premiums include the location, age, and construction of the home, as well as the coverage amount and deductible you choose. Obtaining quotes from multiple insurance providers is recommended to compare rates and coverage options.

Remember, these are estimates. Final costs for both property taxes and insurance can vary. It’s always advisable to factor in a buffer for potential increases when planning your home-buying budget. A knowledgeable real estate agent and insurance broker can be valuable resources in navigating these complex costs.

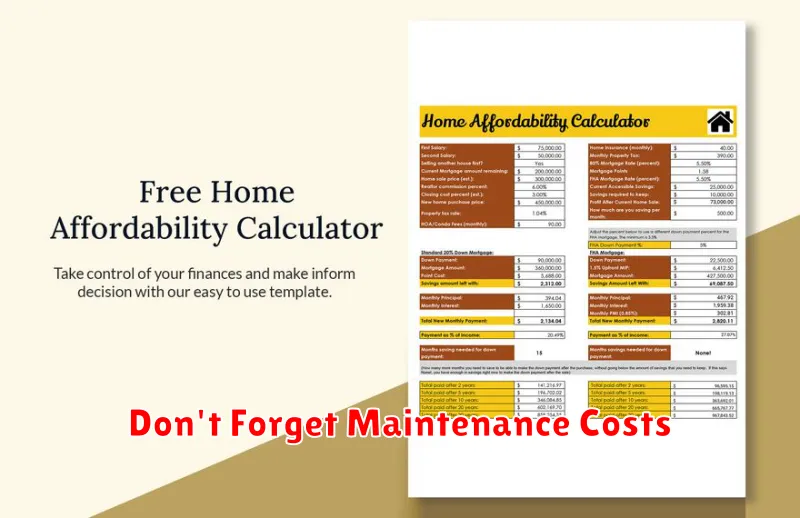

Don’t Forget Maintenance Costs

When budgeting for a new purchase, especially a large one like a car or home, it’s crucial to factor in ongoing maintenance costs. These expenses can add up quickly and significantly impact your overall budget. Failing to account for maintenance can lead to financial strain and potentially defer necessary upkeep, leading to larger, more expensive problems down the line. Think beyond the initial price tag and consider the long-term cost of ownership.

Maintenance costs can vary greatly depending on the item. For example, a car requires regular oil changes, tire rotations, and occasional repairs. A home may need a new roof, appliance replacements, or landscaping. Research typical maintenance expenses for your specific purchase. Create a realistic budget that includes these anticipated costs to avoid unexpected financial burdens. Consider setting aside a dedicated savings account for maintenance to ensure you have the funds available when needed.

By proactively considering and budgeting for maintenance, you can protect your investment and avoid unpleasant financial surprises. Regular maintenance extends the life of your belongings, prevents costly repairs, and ultimately saves you money in the long run. Don’t let maintenance costs catch you off guard – plan ahead and enjoy peace of mind.

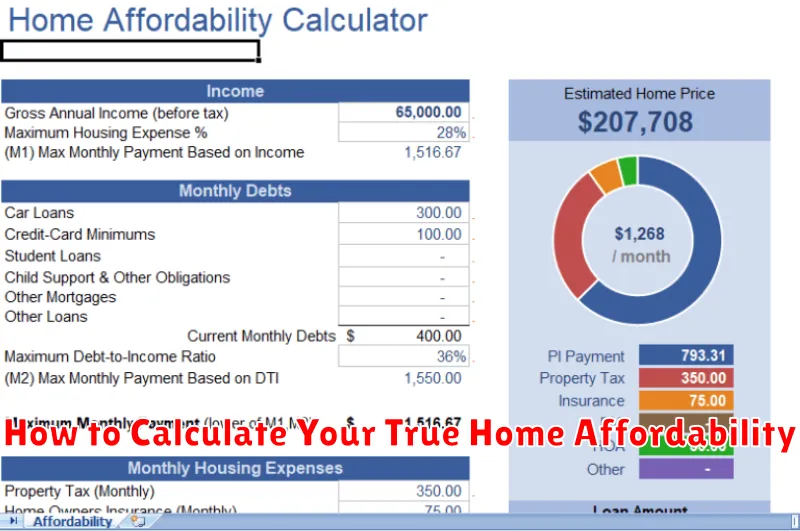

Use Affordability Calculators Online

Affordability calculators are valuable tools for managing personal finances. They help you estimate how much you can realistically afford to spend on significant purchases like a house or a car. By inputting information like your income, debts, and down payment amount, these calculators quickly crunch the numbers and give you an estimated affordable price range. This empowers you to make informed decisions and avoid overspending.

There are many different affordability calculators available online, each designed for a specific purpose. Some focus on housing affordability, taking into account factors such as property taxes and homeowner’s insurance. Others specialize in auto affordability, incorporating loan terms, interest rates, and potential trade-in values. Using the right calculator for your needs will ensure the most accurate and relevant results.

While affordability calculators offer valuable insights, it’s essential to remember that they provide estimates, not guarantees. Your actual affordability can vary based on individual circumstances and unforeseen expenses. It’s always wise to consult with a financial advisor for personalized guidance before making major financial commitments.

Get Pre-Qualification Insights from Lenders

Getting pre-qualified for a loan is a crucial first step in the borrowing process. It involves a lender reviewing your basic financial information, such as your income, debt, and credit score, to estimate how much you can potentially borrow and at what interest rate. This process gives you a valuable preview of your borrowing power without impacting your credit score. Pre-qualification helps you budget realistically for your purchase, whether it’s a home, car, or personal loan, and allows you to shop around with confidence.

Unlike pre-approval, pre-qualification is a less formal assessment. While it provides a helpful starting point, it’s not a guarantee of loan approval. Lenders will conduct a more thorough underwriting process during the formal application stage. This includes verifying your provided information and potentially requesting additional documentation. Remember to provide accurate information during pre-qualification to ensure a smoother transition to the full application.

By obtaining pre-qualification from multiple lenders, you can compare estimated loan amounts, interest rates, and terms. This allows you to choose the offer that best aligns with your financial goals and needs. Don’t hesitate to ask lenders about specific loan products, fees, and the overall application process to make an informed decision.

Plan for Unexpected Costs

Life is full of surprises, and not all of them are pleasant. Unexpected costs, like car repairs, medical bills, or home appliance replacements, can strain your finances if you’re not prepared. Creating a plan to handle these unforeseen expenses is crucial to maintaining financial stability and avoiding debt.

The cornerstone of preparing for the unexpected is building an emergency fund. Ideally, this fund should hold enough money to cover three to six months of essential living expenses. Start small if necessary, consistently contributing what you can afford. Over time, these contributions will accumulate, creating a financial safety net for those inevitable bumps in the road. Keep your emergency fund in a separate, easily accessible account, such as a high-yield savings account.

In addition to an emergency fund, consider other strategies to mitigate financial risk. Insurance, including health, auto, and homeowners or renters insurance, can protect you from significant financial burdens associated with accidents, illness, or property damage. Regularly reviewing and adjusting your insurance coverage ensures you have adequate protection. Also, maintaining your car and home through preventative maintenance can help prevent costly repairs down the line. Finally, evaluate your spending habits and identify areas where you can reduce expenses to free up additional money to contribute to your savings or pay down debt.

Think Long-Term Financial Impact

Making sound financial decisions requires considering the long-term impact. Don’t just focus on the immediate gratification or short-term gains. Long-term thinking involves projecting how a financial decision will affect you in the months and years to come. For example, that “must-have” gadget might seem appealing now, but will you still be happy with it when you’re struggling to pay your bills next month? Consider the opportunity cost. What else could you do with that money that might yield better returns in the future, such as investing or paying down debt? A small, consistent effort towards saving and investing can have a significant impact over time thanks to the power of compounding.

Developing a long-term financial plan requires assessing your current financial situation, defining your goals, and creating a strategy to achieve them. This might involve budgeting, saving for retirement, or investing in a diversified portfolio. It’s essential to consider potential future expenses, such as education costs, healthcare, and unexpected emergencies. Prioritize your goals based on your values and timeline. While it’s wise to plan for the future, it’s also important to remain flexible. Life throws curveballs, so be prepared to adjust your plan as needed. Regularly review and revise your strategy to ensure it aligns with your evolving circumstances and goals.

Seeking professional advice can be invaluable, especially when dealing with complex financial matters. A financial advisor can provide personalized guidance tailored to your specific situation and goals. They can help you develop a comprehensive financial plan, choose appropriate investments, and manage risk effectively. While there are costs associated with professional advice, the potential long-term benefits can outweigh the expenses. Remember, making informed decisions today can pave the way for a more secure and prosperous financial future.

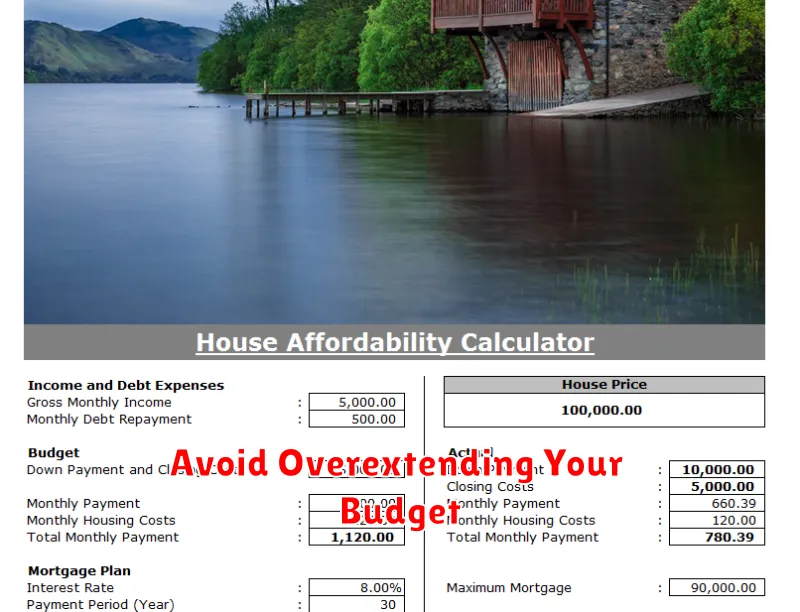

Avoid Overextending Your Budget

Creating and sticking to a budget is crucial for financial stability. Overextending your budget can lead to debt, stress, and difficulty achieving your financial goals. Carefully track your income and expenses to ensure you’re spending less than you earn. One common pitfall is impulse purchases. Before buying something, ask yourself if it’s a need or a want. Prioritizing needs over wants helps you stay within your budget.

Several strategies can help you avoid overspending. Meal planning can significantly reduce food costs. Look for sales and discounts on groceries and other essential items. Consider less expensive alternatives for entertainment, like free community events or streaming services instead of cable. Setting realistic financial goals, such as saving for a down payment or paying off debt, can also motivate you to stay on track.

Regularly review and adjust your budget as needed. Life changes, such as a new job or unexpected expenses, may require adjustments to your spending plan. By staying mindful of your finances and making conscious spending choices, you can avoid overextending your budget and achieve your financial goals.